本期经济学人杂志【经济金融】板块下这篇题为《A bull market returns: Stockmarket mania comes to China again. Can it last this time?》的文章关注的是最近高歌猛进的中国股市。文章认为,人们有理由对中国股市保持乐观,但同时也要注意“非理性繁荣”的迹象。

在中国的股市神话中,“慢牛”(稳定、可信赖的增长)很少见。过去 20 年间曾出现过两次“快牛”,但没有哪一次持续时间超过一年,最后都逐渐步入漫长的熊市。

过去一周,中国股市上涨了 15%,且较 3 月低点上涨超过 30%。有人认为本轮股市上涨会比过去持续时间长一些。

- IMF 报告预计中国将会是今年唯一一个录的正增长的大经济体,并预计明年中国经济将出现最强劲的反弹;

- 美国疫情状况令人担忧,但中国认真应对每一次新疫情,这给人们和商业带来更多确定性;

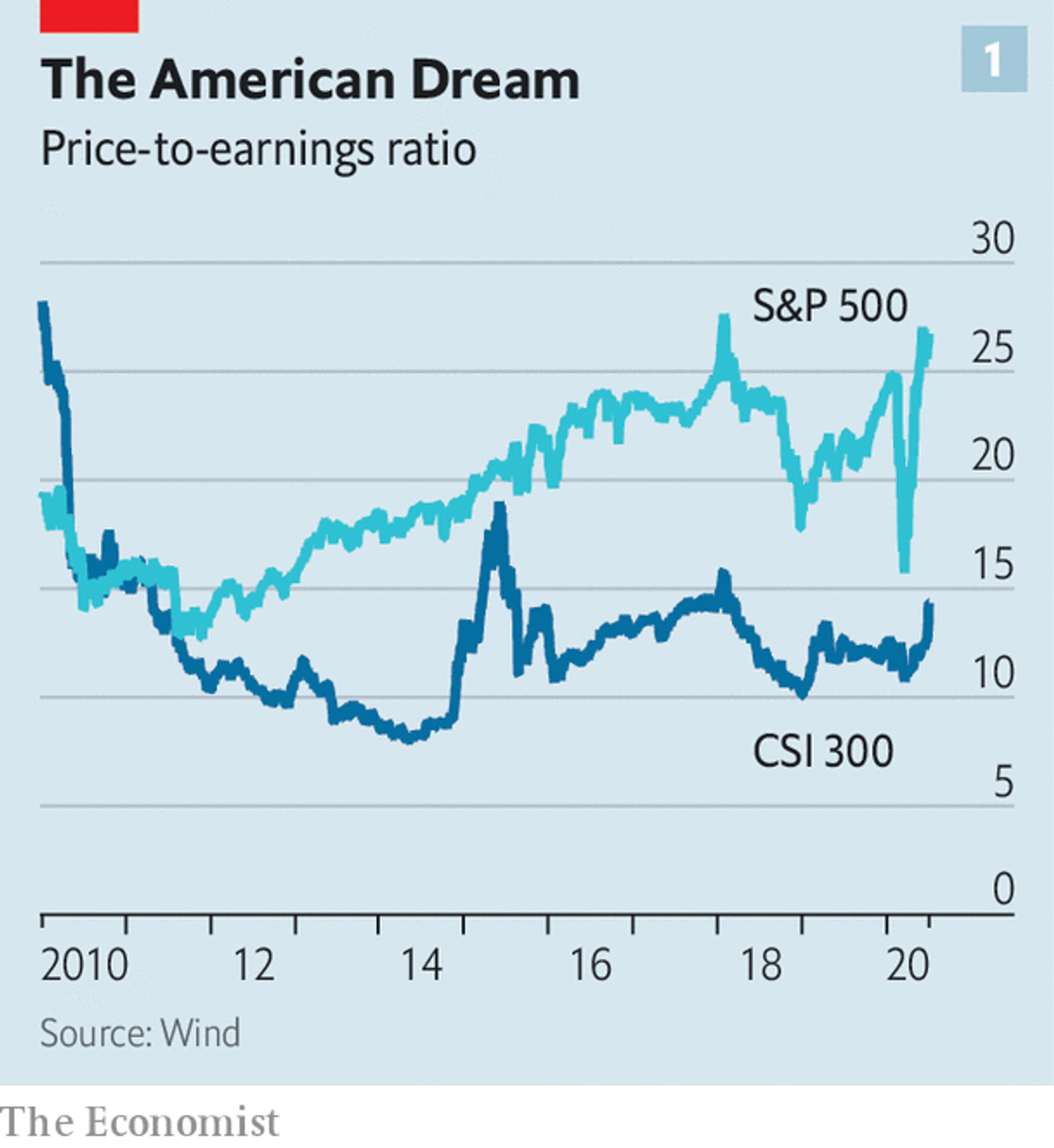

- 中国股市估值相对合理。目前沪深 300 市盈率为 14,远低于标普 500 的 27;

- 7 月前三个交易日,通过香港流入的外资高达创纪录的 440 亿元人民币;

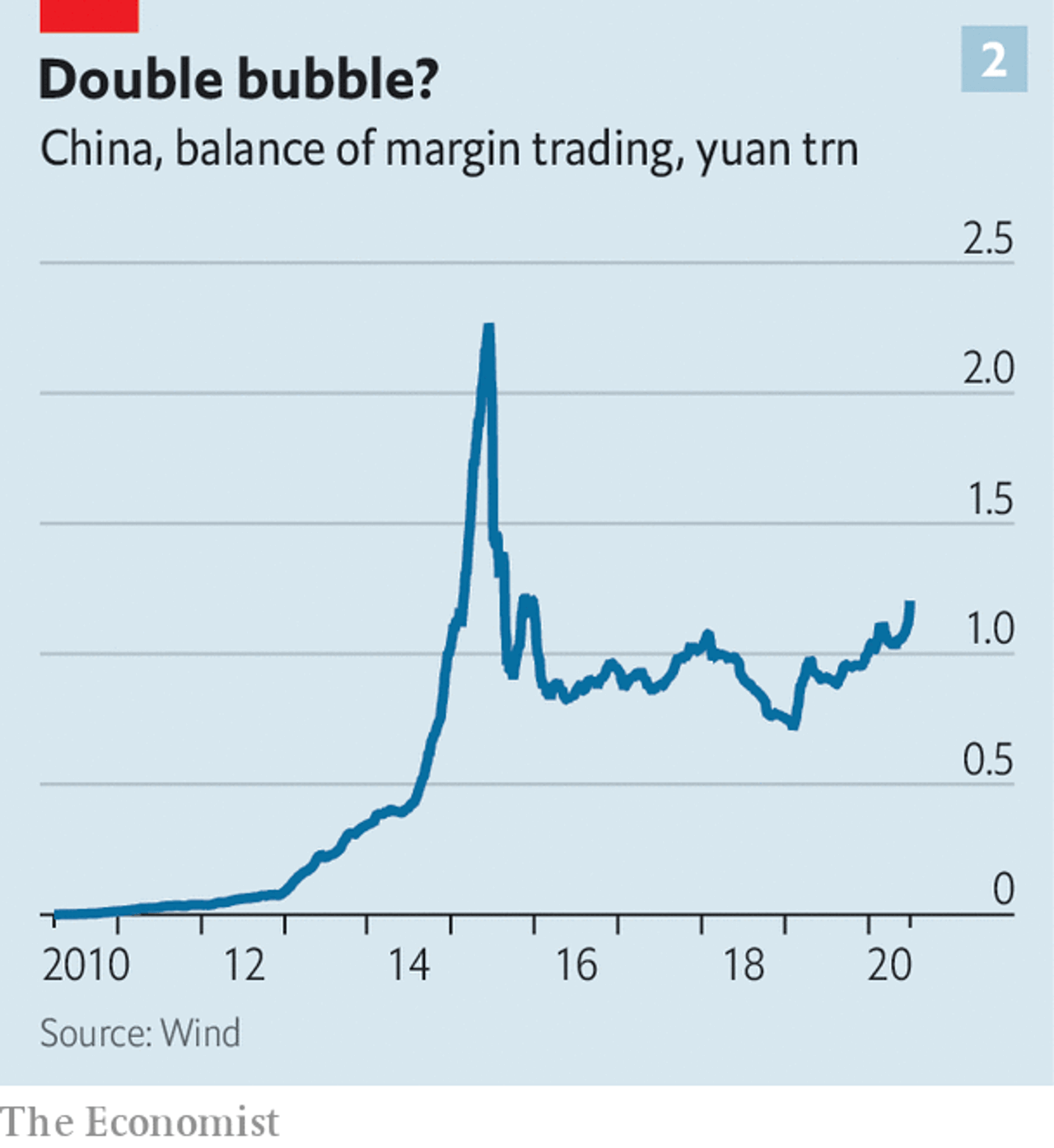

- 有些人开始借钱炒股了,但目前沪深两市融资余额只有 2015 年最疯狂时候的一半等。

但对股价影响很大的公司利润的前景依然低迷,2020 年 1-5 月全国规模以上工业企业利润下降了 19%。

随着股市不断高涨,有些媒体再次开始充当“拉拉队”的角色。文章认为,根据以往的经验这可能是股市出现“非理性繁荣”的迹象之一。“健康牛”只要吃草就好了,强行注射激素反而可能适得其反。

Stockmarket mania comes to China again. Can it last this time?

A new bull market in China

Stockmarket mania comes to China again. Can it last this time?

There are grounds for optimism but also signs of irrational exuberance

Finance & economics

Jul 7th 2020

SHANGHAI

IN CHINESE STOCKMARKET mythology, the rarest of beasts is the slow bull. The past couple of decades have brought two fast bulls: vertiginous surges in share prices, neither lasting more than a year. Those soon led to fast bears when stocks crashed and, eventually, to slow bears as the descent became more gradual. Most of the time there have been what might be termed long worms as the market moved sideways, such that the CSI 300 index, a gauge of China’s biggest stocks, has averaged the same level over the past five years that it first hit back in 2007. The slow bull—a steady, almost dependable, rise year after year, well known to investors in America—has remained elusive.

China’s indomitable punters now hope that a trundling taurus has at last arrived. Stocks have jumped by 15% during the past week and they are up by more than 30% from their low in March. But some believe the bull run will be more enduring than those of the past.

For starters, China appears to be in better economic shape than other large economies. Because investors must allocate their funds somewhere, there is always a comparative element to market performance. China is the only big economy forecast to grow this year and is still expected to record the strongest rebound next year, according to IMF projections published in late June. There are grave concerns about the toll that the coronavirus might take in America during this autumn’s flu season. But China has shown every intention of smothering renewed outbreaks, giving people and businesses greater certainty about the path ahead.

Market dynamics also seem to be helping. Even after the rally, valuations in China are reasonable. The CSI 300 trades at 14 times the value of company earnings, far below the 27-times multiple of the S&P 500, America’s most-watched share index (see chart 1). Foreign investors have more ways to enter China's previously walled-off market; many are compelled to do so, because its shares are now included in key indices tracked by institutions. During the first three trading days of July, 44bn yuan ($6bn) flowed into Chinese equities via accounts in Hong Kong, a record high for any three-day period.

Although more investors have started buying shares with borrowed money, the outstanding balance of such margin trading is just over half its peak five years ago, during China's most recent manic run (see chart 2). It is now easier for companies to list shares on the mainland, so new offerings should absorb some of the cash rushing into the market."This lays the foundation for a slow-bull market that could last for ten or 20 years,” said Chang Shishan of Kangzhuang, an asset-management firm.

Nevertheless, it is hard to shake the feeling that the optimists might once again be getting ahead of themselves. The outlook for profitability, which ultimately should determine share prices, is still grim. Over the first five months of 2020, industrial profits were down by 19% compared with a year earlier.

Most worrying is the way that the Chinese media are swinging into cheerleading mode, one of the tell-tale signs of past episodes of irrational exuberance. “The clicking of the bull’s hooves is a beautiful sound for our post-virus era,” declared a front-page editorial in the China Securities Journal, a state-run paper, on July 6th. The Shanghai Securities, its sister paper, was less poetic but more direct in an article posted online on July 3rd:"Hahahahaha! It looks more and more like a bull market!" Healthy bulls need only a diet of grass. Injecting them with steroids is an invitation to trouble.