本期经济学人【经济金融】板块这篇题为《China is calm as growth slows. But is it complacent?》的文章关注了贸易战下的中国经济,特朗普政府挑起的贸易战正在损害中国经济,但中国似乎表现淡定并没有出台强刺激方案来拉动经济。

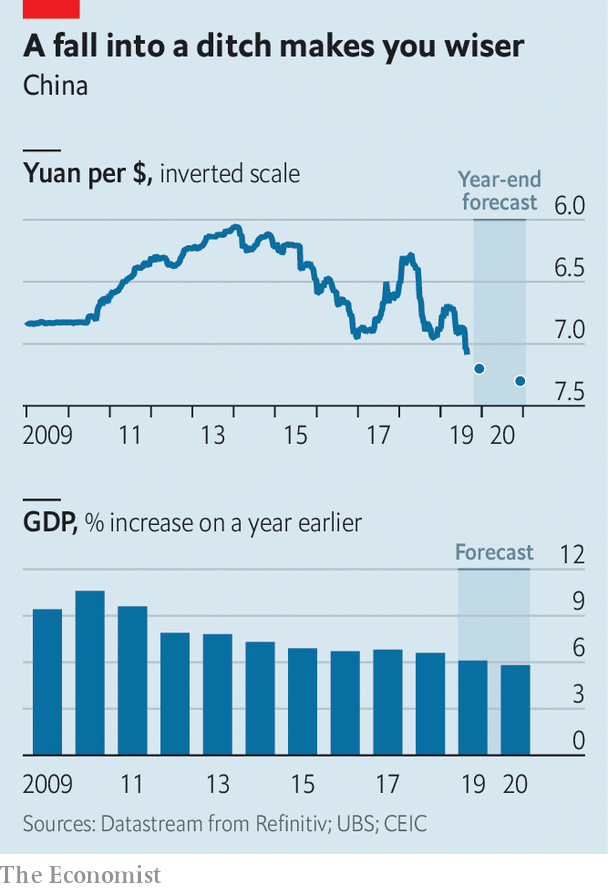

如果五年前你问经济学家哪两个数字可以用来概括中国经济,他们会说中国经济很有活力,能保持每年 7% 的增速,人民币对美元在升值,汇率会直至一美元对 5 块人民币。但贸易战阴云下,经济学家们预计这两个数字会反过来。

8 月 26 日,特朗普在的 G7 峰会的一场新闻发布会上吹嘘自己的策略奏效了,中国的日子不好过。但如果好好解读中国的政策人们会发现,面对经济放缓的挑战中国非常淡定 (surprising calm)。贸易争端确实对中国经济产生了一些可见的影响,比如工业价格指数突然转为通缩 (注一),这对工业利润是个不好的预兆。有摩根士丹利的经济学家预计明年中国经济增速可能降至 5.8% 以下,之前的预测值是 6.3%。

以前中国经济一旦有点下滑的苗头,企业就期望政府推出刺激大礼包来缓解困境。但这次官员们似乎很谨慎,部分原因是担忧这可能加剧本就高企的债务负担。本来 8 月 26 日,中国央行本有机会降息,但它却没有这样做,顶住了 (bucking) 目前全球的低利率趋势 (注二)。

8 月 27 日,国务院办公厅印发《关于加快发展流通促进商业消费的意见》,提出了 20 条稳定消费预期、提振消费信心的政策措施。一些分析人士本来希望国务院会出台定向减税和补贴措施来刺激经济。另外,中国也通过把美元对人民币汇率降至 7.1 来部分抵消关税的不力影响。

但有些人认为中国的这种淡定像是过度自满,没有充分意识到风险。中国不仅没有出台大规模刺激计划,反而对经济支柱之一的房地产加强管理,打击房地产炒作并收紧信贷。有经济学家打了个医学上的比方 (很无趣。。。),认为收紧房地产信贷不太可能带来稳定的经济增长。文章最后以一句话收尾: In other words, things could get ugly.

注一: 这里应该指的是 2019 年 6 月我国的工业价格指数 (PPI) 从环比看,由上月上涨 0.2% 转为下降 0.3%。(veered into deflation)

注二: 可以看之前的文章《经济学人: 美联储十年来首次降息》

China is calm as growth slows. But is it complacent?

The other inversion

China is calm as growth slows. But is it complacent?

Though the trade war is hurting, officials are reluctant to unleash stimulus

Half a decade ago, if you had asked economists which number—five or seven—described China’s gdp and which its currency, most would have answered this way: growth will remain strong at around 7% annually, and the currency will strengthen until it takes just five yuan and change to buy a dollar. One measure of the impact of Donald Trump’s trade war on China is the inversion of these digits. As American tariffs bite, economic forecasters think that Chinese growth next year will slow to five-point-something percent. The yuan, for its part, has slumped to more than seven per dollar.

Mr Trump has crowed about the success of his tactics. “China has taken a very hard hit,” he said on August 26th at a news conference after the g7 summit in France. “They want to make a deal very badly.” But a more accurate reading of China’s policy stance is one of surprising calm in the face of the economic slowdown and, by extension, of stiffer resolve in the trade dispute.

The toll of tariffs on China’s economy is becoming more visible. Although exports to America account for just a small share of overall gdp, the uncertainty has bruised corporate confidence. Investment spending is on track to increase this year at its weakest pace in at least two decades. Factory prices have veered into deflation, a bad sign for industrial profits. Economists at Morgan Stanley, a bank, now forecast that Chinese growth will fall to 5.8% next year; previously they had expected 6.3%.

In the past, whenever growth looked set to slow sharply, Chinese companies could count on a stimulus package to revive it. But this time officials have been much more restrained in their response, partly because of concern about adding to China’s hefty debt burden. On August 26th the central bank had a chance to lower funding costs for banks, but it refrained, bucking the global trend towards lower rates. On August 27th the State Council, or cabinet, issued an underwhelming 20-point plan to promote consumption. Some analysts had been hoping for targeted tax cuts or subsidies; instead, it made small-bore promises, such as more 24-hour convenience stores.

The Chinese government’s lack of panic about the economic outlook should give Mr Trump pause. “Its leadership now looks committed to a strategy of toughing out trade tensions,” says Andrew Batson of Gavekal, a research firm. It helps that China has procured insurance in letting its exchange rate decline to 7.1 yuan per dollar, the weakest since 2008, offsetting some of the drag from tariffs.

But some think the calm is verging on complacency. Not only has China’s government refrained from stimulus, but it has become more hawkish about the property sector, the engine of its economy. In line with President Xi Jinping’s oft-repeated warning that investors should not speculate on housing, regulators have curtailed lending to developers and sworn off cutting mortgage rates. “We would view stabilising growth by choking credit to the property sector as analogous to performing cardiac surgery without blood pumps, oxygen and anaesthesia,” says Lu Ting, an economist with Nomura, a bank. In other words, things could get ugly. ■

This article appeared in the Finance and economics section of the print edition under the headline"The other inversion"

Print edition | Finance and economics

Aug 29th 2019 | SHANGHAI