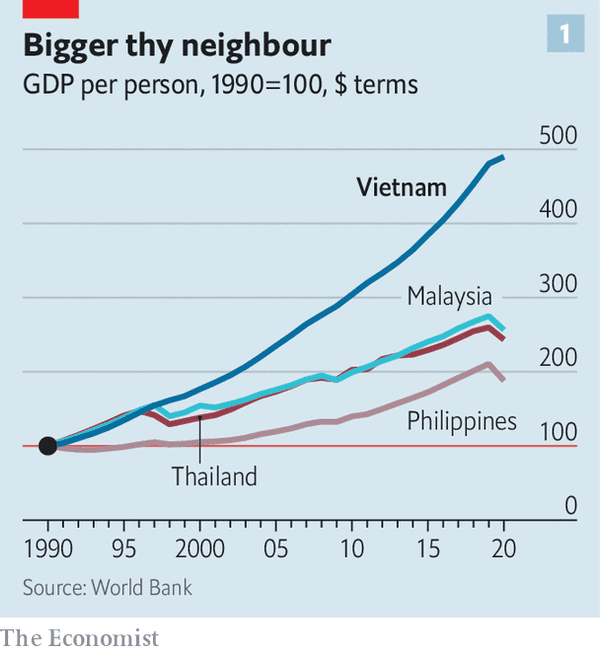

本期经济学人杂志【经济金融】板块下这篇题为《The economy that covid-19 could not stop》的文章关注的是越南的经济发展模式,过去 30 年越南是全球经济增速最快的五个国家之一,但未来要想实现更好地发展,越南需要进行进一步的改革。

贸易密集

疫情影响下,2020 年越南的 GDP 仍保持 2.9% 的正增长,世界银行的最新估计显示,2021 年越南的 GDP 增速可能达到 4.8%。

得益于开放的贸易和投资环境,人均 GDP 仅 2,800 美元的越南已成为全球供应链中的重要一环。越南政府希望越南到 2045 年成为高收入国家,要想实现这一目标,每年的经济增长率要达到 7%。

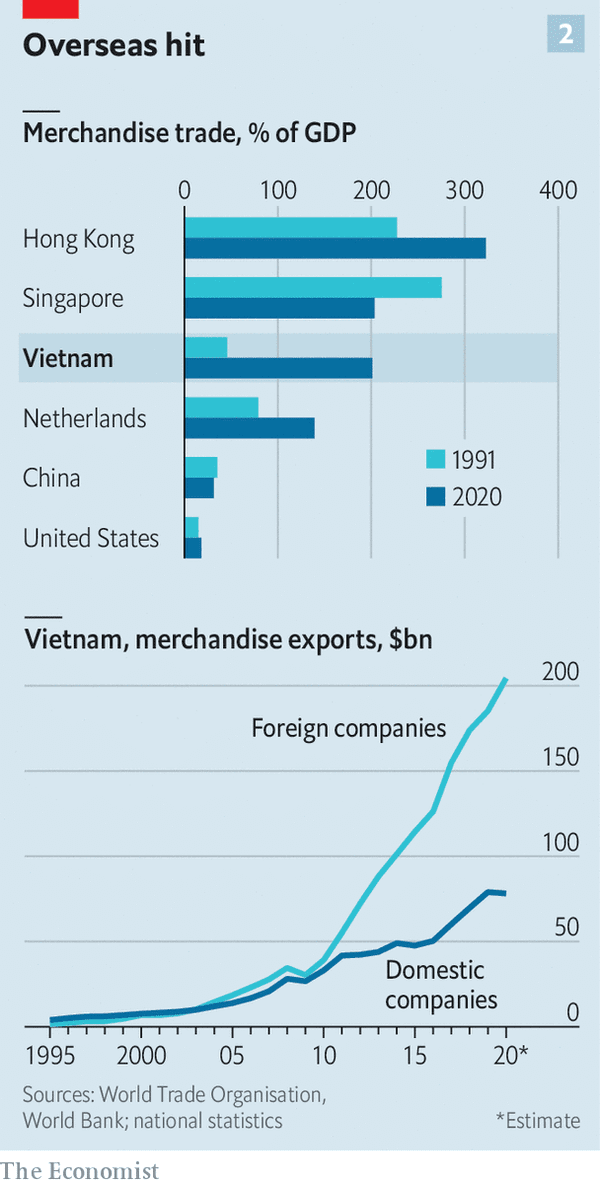

越南的货物贸易额占 GDP 的比重超过 200%,全世界除了资源非常丰富的国家和以海上贸易为主的城市国家(或地区)外,很少有经济体的经济像越南这样高度贸易密集。(图二)

依赖外资

随着东亚其他地区工资的上涨,全球制造商逐步将向拥有低廉劳动力成本和稳定汇率的越南迁移。过去十年中,越南国内企业和外资企业的出口分别增长了 137% 和 422%。

越南经济高度依赖外国公司的投资和出口,国内的公司却表现不佳,外国公司和国内公司之间不断扩大的差距正对越南的经济成长带来威胁。

国营企业

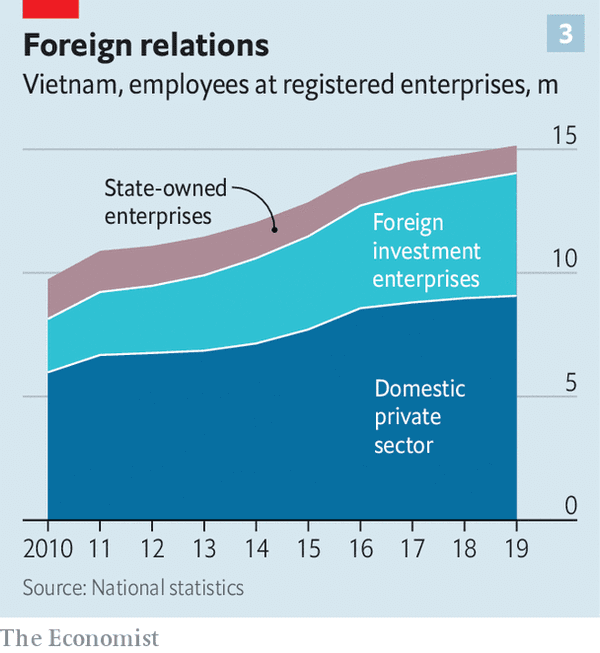

拖累国内企业发展的原因之一是越南的国营企业,虽然它们在全国经济和就业中的重要性已经减弱(图三),但仍凭借其在银行体系中的地位从银行获取低息贷款。尽管外资企业可以很容易从国外融资,但 2020 年越南的银行中长期平均贷款利率仍高达 10.25%。

为了激发私营企业的活力,越南政府希望通过减税等措施培育类似于韩国财阀或日本经连会的大型企业集团,其中的一家 Vingroup 是越南最大的私营企业,其业务遍及旅游、教育、健康和地产等。

但由于越南是 CPTPP 的成员,同时也加入了一系列其他的贸易和投资协议,这意味着越南政府向国内生产商提供优惠待遇的同时,对外国企业也要一视同仁。

改革

随着越南经济的发展,保持外国企业出口的快速增长将变得越来越困难;保持对外资的开放和培育国内大企业之间的紧张关系将变得更加尖锐。

文章认为,对国内私营部门和金融体系的改革是越南政府的首要任务,如果不进行改革,越南政府想要快速富裕的崇高目标可能无法实现。

The economy that covid-19 could not stop

The economy that covid-19 could not stop

Trade and foreign investment helped Vietnam emerge from extreme poverty. Can they make it rich?

This performance hints at the real reason to be impressed by Vietnam. Its openness to trade and investment has made the country, with GDP per capita of a mere $2,800, an important link in supply chains. And that in turn has powered a remarkable expansion. It has been one of the five fastest-growing countries in the world over the past 30 years, beating its neighbours hands down (see chart 1). Its record has been characterised not by the fits and starts of many other frontier markets, but by steady growth. The government is even more ambitious, wanting Vietnam to become a high-income country by 2045, a task that requires growing at 7% a year. What is the secret to Vietnam’s success—and can it be sustained?

Vietnam is often compared to China in the 1990s or early 2000s, and not without reason. Both are communist countries that, led by a one-party political system, turned capitalist and focused on export-led growth. But there are big differences, too. For a start, even describing Vietnam as export-intensive does not do justice to just how much it sells abroad. Its goods trade exceeds 200% of GDP. Few economies, except the most resource-rich countries or city states dominated by maritime trade, are or have ever been so trade-intensive.

It is not just the level of exports but the nature of the exporters that makes Vietnam different from China. Indeed, its deep connection to global supply chains and high levels of foreign investment make it seem more like Singapore. Since 1990 Vietnam has received average foreign-direct-investment inflows worth 6% of GDP each year, more than twice the global level—and far more than China or South Korea have ever recorded over a sustained period.

As the rest of East Asia developed and wages there rose, global manufacturers were lured by Vietnam’s low labour costs and stable exchange rate. That fuelled an export boom. In the past decade, exports by domestic firms have risen by 137%, while those by foreign-owned companies have surged by 422% (see chart 2).

But the widening gap between foreign and domestic firms now poses a threat to Vietnam’s expansion. It has become overwhelmingly dependent on investment and exports by foreign companies, whereas domestic firms have underperformed.

Foreign firms can continue to grow, providing more employment and output. Yet there are limits to how far they can drive Vietnam’s development. The country will need a productive services sector. As living standards rise it may become less attractive to foreign manufacturers, and workers will need other opportunities.

Part of the drag on domestic enterprise comes from state-owned firms. Their importance in overall activity and employment has shrunk (see chart 3). But they still have an outsize effect on the economy through their preferential position in the banking system, which lets them borrow cheaply. Banks make up for that unproductive lending by charging other domestic firms higher rates. Whereas foreign companies can easily access funding overseas, the average interest rate on a medium- or long-term bank loan in Vietnamese dong ran to 10.25% last year. Research by academics for the Centre for Economic Performance at the London School of Economics also suggests that productivity gains in the five years after Vietnam joined the World Trade Organisation in 2007 would have been 40% higher without state-owned firms.

To fire up the private sector, the government wants to nurture the equivalent of South Korea’s chaebol or Japan’s keiretsu, sprawling corporate groups that operate in a variety of sectors. The government is “trying to create national champions”, says Le Hong Hiep, a senior fellow at the ISEAS-Yusof Ishak Institute in Singapore, and a former Vietnamese civil servant.

Vingroup, a dominant conglomerate, is the most obvious candidate. In VinPearl, VinSchool and VinMec, it has operations that spread across tourism, education and health. VinHomes, its property arm, is Vietnam’s largest listed private firm by market capitalisation.

The group’s efforts to break into finished automotive production through VinFast, its carmaker, may become important for the economic development of a country that is usually known for intermediate manufacturing. In July the company’s Fadil car, which is based on the design for Opel’s Karl make, became Vietnam’s best-selling model, beating Toyota’s Vios. VinFast has grand ambitions abroad, too. In July it announced that it had opened offices in America and Europe and intended to sell electric vehicles there by March 2022.

Fostering national champions while staying open to investment is not easy, however. VinFast benefits from a bevy of tax reductions, including a large cut in corporation tax for its first 15 years of operation. In August, state media also reported that the government was considering reinstating a 50% reduction in registration fees for locally built cars that expired last year.

But the country’s membership of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, and a range of other trade and investment deals, means that it cannot offer preferential treatment to domestic producers. It must extend support to foreign firms that make cars in Vietnam, too. (By contrast, China’s trade policy, which prefers broad but shallow deals, does not constrain domestic policy in quite the same way.)

Vietnam may also hope to rely on another source of growth. The economic boom has encouraged its enormous diaspora to invest, or even to return home. “There aren’t a lot of economies that are experiencing the sort of thing that Vietnam is,” says Andy Ho of VinaCapital, an investment firm with $3.7bn in assets. His family moved to America in 1977, where he was educated and worked in consulting and finance. He returned to Vietnam with his own family in 2004. “If I were Korean, I might have gone back in the 1980s, if I were Chinese I might have gone back in 2000.” Its successful diaspora makes Vietnam one of the largest recipients of remittances in the world; $17bn flowed in last year, equivalent to 6% of GDP.

The setback from covid-19 aside, it might seem hard not to be rosy about a country that appears to be in the early stages of emulating an East Asian economic miracle. But no country has become rich through remittances alone. As Vietnam develops, sustaining rapid growth from exports of foreign companies will become increasingly difficult, and the tension between staying open to foreign investment and promoting national champions will become more acute. All of that makes reforming the domestic private sector and the financial system paramount. Without it, the government’s lofty goal of getting rich quick may prove beyond its reach. ■