本期经济学人杂志【经济金融板块】这篇题为《Japan’s new investment rules risk scaring off foreign investors》的文章报道的是日本新的投资法案将针对外国资本对日本重要企业的投资以及董事选拔建议等加强管制,日本称此举是为了与欧美保持一致,防止尖端技术及机密情报外流,文章认为这将打击投资者在日投资的信心。

日本首相安倍晋三在 2012 年底上台后加速实施了一系列刺激经济政策,外界将其称之为“安倍经济学” (Abenomics),这些经济政策中也包含吸引外资的政策。目前海外投资者持有日经指数股票 30% 的份额,每日股票成交量占东京股票交易所成交量的 70%。日本政府最新推出的加强外资管制的外汇法修正案可能影响外资在日投资。

以前,外资持有日本上市公司 10% 以上的股票时才需事先申报,10 月 8 日公开的提议将外汇法修正案中这一比例降至 1%。如果外国投资者向想要进入日本企业的董事会,也需要事先申报。

日本财务省称外汇法修正案旨在保护本国敏感产业,比如能源和武器制造业。但外界担忧这会阻碍正常交易,对此日本财务省在 10 月 18 日明确外国机构投资者 (portfolio investors) 只要保证它们不会影响被投资企业的管理,那就不需要事前申报。

但这并没有打消投资者的疑虑。一方面,法案囊括的范围很广,除了核能和航空业,也包含农业、交通、船运、软件和互联网服务等;另一方面,该修正法案没有明确到底何种行为才算违规。这些都可能导致在日投资变得复杂且耗时。

日本官员陈此举只是像欧美看齐,但有外国银行人士指出外汇法修正案的只要目标是那些想要在投资的日本企业董事会拥有席位的活跃投资者。因为长期以来这些活跃投资者一直想让日本企业出售非核心资产、少囤现金、提高分红。甚至近年来他们还和日本的一些大企业发生冲突,干预企业管理。

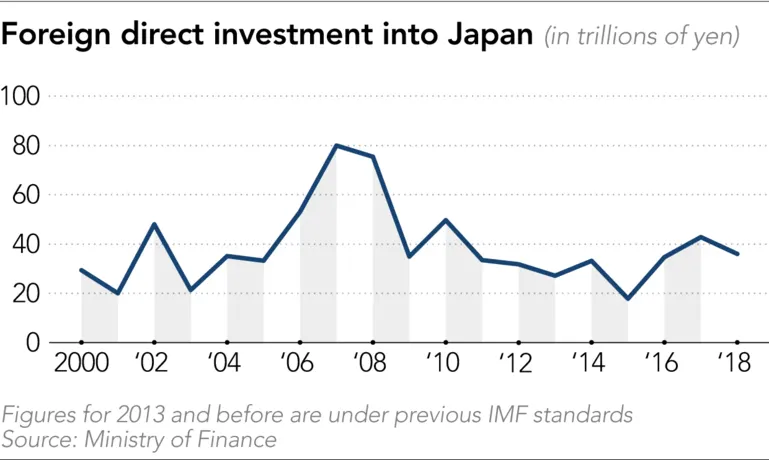

去年外国投资者抛售了大约 480 亿美元的日本股票,在一定程度上这反映出他们怀疑日本政府的改革诚意。Overseas investors once bought Abenomics. Now they want to sell. ■

Japan’s new investment rules risk scaring off foreign investors

Capital control

Japan’s new investment rules risk scaring off foreign investors

Analysts suspect activist investors may be their real target

Print edition | Finance and economics

Oct 26th 2019| TOKYO

“Buy my abenomics!”, Shinzo Abe, Japan’s prime minister, pleaded to the New York Stock Exchange in 2013. As he lowered the drawbridge to foreign investors, that pitch seemed to work. Today overseas owners hold 30% of Japan’s topix index of stocks and account for about 70% of the daily turnover on the Tokyo Stock Exchange (tse). But new rules threaten to reverse these trends.

A proposed change to the Foreign Exchange and Foreign Trade Act, unveiled on October 8th, will lower the minimum stake foreigners can buy in many listed Japanese companies without prior government approval, from 10% to 1%. Other changes include requiring foreign directors to seek official permission before they sit on the boards of Japanese firms.

The finance ministry says it wants to protect sensitive sectors such as energy and weapons manufacturing. But analysts warned that the rules could choke off investment. Akira Kiyota, the head of the tse told the Financial Times they were “absolutely idiotic”. Under fire, the finance ministry clarified on October 18th that foreign “portfolio investors” (such as banks, insurance firms and asset managers) would not need to seek prior approval, as long as they could prove they had no intention “to influence management”. The tweaked legislation was approved by the cabinet and is expected to be passed in parliament by early December.

But concerns linger. One is the law’s broad scope. In addition to nuclear power and aeronautics, its purview includes agriculture, transport, shipping, software and internet services. Nor is it clear what counts as infringement. Would a letter from a foreign investor to the board of a Japanese firm, say, be considered an attempt to influence management? The upshot is that investing becomes more convoluted and time-consuming. One analysis concludes that the new rules mean an eight-fold increase in applications to the government.

Officials say they are just playing catch-up. The European Union tightened its screening of inward investment in April. America has expanded its regime, and even prodded Japan to reduce Chinese access to sensitive technology. But a foreign banker in Tokyo says the real target is activist investors. “The wording in Japanese is very specific about targeting investors who want a say on boards.”

Activists have long fought for Japanese companies to sell non-core assets and stop hoarding cash. In recent years they have clashed with some of the nation’s corporate giants. They have been leaning on Nissan to sack its managers and draw a line under the era of Carlos Ghosn, the carmaker’s former boss. Earlier in the year a New York investment fund tried to force Kyushu Railway, a regional transport firm, to boost stingy returns to shareholders.

Ironically, Mr Abe can take some credit for this flurry of activism. By badgering bosses to change crusty boardroom practices, he has emboldened investors. The number of big listed firms with two or more external directors, for instance, has tripled since a corporate-governance code was introduced in 2015.

But many foreign investors already seem to be questioning the sincerity of the government’s reforms. Last year they dumped ¥5trn ($48bn) of Japanese stocks. Overseas investors once bought Abenomics. Now they want to sell. ■

This article appeared in the Finance and economics section of the print edition under the headline"Capital control"

Print edition | Finance and economics

Oct 26th 2019| TOKYO