本期经济学人杂志【经济金融】板块的这篇题为《As profits dwindle, HSBC plans a radical overhaul》的文章关注的是汇丰银行面临利润逐渐减少等困境下计划进行一场大规模的改革。

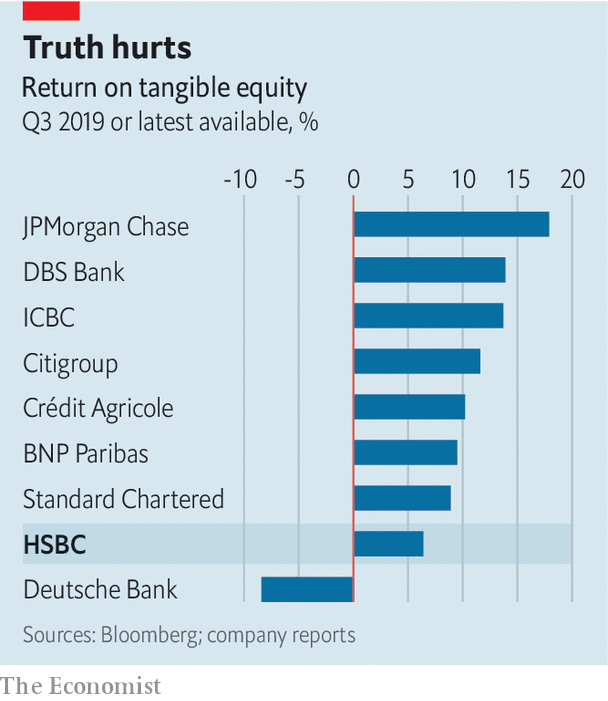

汇丰银行是欧洲最大的银行,10 月 28 日公布的财报显示三季度录得净利润 30 亿美元,同比下降 24%,高于分析师预计的下降百分比 14%。三季度总收入为 134 亿美元,同比减少 3.2%。主要利润指标有形股本回报率(ROTE)降至 6.4%,低于分析师预计的 9.5%,汇丰此前设定的 2020 年 ROTE 的目标为 11%。

汇丰目前面临的悲观的商业前景主要是由以下几个方面的因素造成: 宽松的货币政策周期、放缓的全球经济、英国脱欧造成的商业不确定性、中美贸易战环境下的紧张气氛(注一)以及香港市场的不稳定等。2018 年 2 月开始,当时 49 岁的 Flint 成为汇丰历史上最年轻的行政总裁,但仅仅过了 18 个月就意外宣布辞职,目前的代理总裁是 Quinn。

面对困境,Quinn 宣布加快改革、重塑业务。汇丰 8 月底宣布今年年底要完成裁员 4,700 人,并暗示还可能会从 23.8 万名员工中进一步裁撤 8,000-10,000 人。但在多年成本削减后,分析师们对此次裁员还能否压缩大量成本看法不一。

文章认为汇丰还应当将精力放在资本全球有效配置上,把资金投入到回报高增长高回报的地区和业务上。汇丰在欧洲和亚洲的成本-收入比分别为 104% 和 43%,亚洲地区贡献了公司 90% 的利润。汇丰在英国投放了 1/4 的贷款,但英国产生的违约的贷款占总违约贷款的 35%。公司在在美国有 980 亿美元的风险资产,但仅贡献了 5.27 亿美元的年利润。

研究机构的报告称通过市场渗透,汇丰已成为亚洲最大的企业贷款人,但去年因为帮助美国政府调查华为高管,汇丰在华业务面临挑战。中国央行 8 月 17 日公布的 18 家参与贷款市场报价利率(LPR 注二)形成机制改革的商业银行中没有包括汇丰银行。

文章最后强调,对于重组业务线汇丰银行也面临一些困难,相比外部因素而言,汇丰自身在全球把业务摊子铺得太大才是造成目前困境的主要原因(Too big to thrive)。

注一: Trade Finance: 汇丰是全球最大的贸易金融提供者,但汇丰未能将它在这方面的优势进一步扩展到投行业务。

注二: LPR 是由中国央行授权全国银行间同业拆借中心发布、目前由 10 家商业银行根据市场供求等因素报出的优质客户贷款利率,该利率于 2013 年 10 月正式运行,而在此次调整后,银行将有 10 家扩大至 18 家。

As profits dwindle, HSBC plans a radical overhaul

Failure to thrive

As profits dwindle, HSBC plans a radical overhaul

Europe’s largest bank has been hit by the trade war and Brexit; but its woes point to deeper problems

WHEN NOEL QUINN took over as interim chief executive of HSBC from John Flint, ousted by the board in August, analysts expected a change in style. Whereas Mr Flint was seen as a cerebral introvert, Mr Quinn is forthcoming, verging on blunt.

On that front, at least, HSBC’s first quarterly-results announcement on his watch did not disappoint. Although its Asian business “held up well in a challenging environment”, performance in other areas was “not acceptable”, Mr Quinn said on October 28th. Third-quarter net profits, down by 24% on the same period last year, to $3bn, undershot pundits’ forecasts by 14%. Revenues fell by 3.2%, to $13.4bn, missing expectations by 3%. Return on tangible equity (ROTE), its chief measure of profitability, reached 6.4%, compared with analysts’ forecast of 9.5%. Investors agreed with Mr Quinn: the bank’s shares dropped by 4.3% on the news in London. They have fallen by about 11% in the past six months.

HSBC’s woes can be blamed in part on broader conditions: low interest rates, a slowing global economy, business uncertainty in Brexit-hit Britain and trade tensions (HSBC is the world’s largest provider of trade finance). Yet that is hardly likely to reassure investors. Tom Rayner of Numis Securities, a broker, points out that although some of these trends may be reversed, others, such as Brexit and the trade wars, may linger. Interest rates may well fall further. Investors are not yet pricing in any impact from protests in Hong Kong, where HSBC is the largest lender. That is too optimistic, says Fahed Kunwar, at Redburn, another broker.

Mr Quinn does not deny the scale of the challenge. HSBC is ditching its ROTE target of 11% for 2020, and there are hints of a radical overhaul. Mr Quinn spoke of accelerating plans to “remodel” poorly performing businesses. In August the bank announced a plan to complete 4,700 redundancies by the end of this year. Reports suggest HSBC could seek to cut an additional 8,000-10,000 jobs from its headcount of 238,000 (a spokesperson declined to confirm the number of jobs to go).

Yet after years of cost-cutting, analysts are divided as to whether much more fat can be trimmed. Daniel Tabbush of Tabbush Report, an Asia-based research firm, says HSBC “is not particularly bloated”. The bank may also partially exit some share-trading activities in Western markets, and wants to sell its French retail operations. But a hasty disposal of badly performing units, which also include its American wholesale arm, may force it to write down part of their value.

So hopes must be placed in the second prong of HSBC’s grand reform—to move capital away from the dreariest businesses and towards “higher growth and return opportunities”. HSBC’s cost-to-income ratio is 104% in Europe, compared with 43% in Asia, where it generates nearly 90% of its profits. It makes only a quarter of its lending in Britain, yet the country generates 35% of its non-performing loans, says Mr Tabbush. Its $98bn of risk-weighted assets allocated to America produce only $527m in annual profit.

The bank’s management has so far declined to provide any guidance as to where newly released capital might be sent. HSBC is already the largest corporate lender in Asia by market penetration, according to Greenwich Associates, a research firm. And getting more deeply into China may prove tricky. In August HSBC was omitted from a list of banks helping Beijing set a new interest-rate benchmark. That suggests the Chinese regulator may be shunning the bank over its role in assisting an American investigation into a key executive at Huawei, a Chinese telecoms firm. Other dynamic markets, like Vietnam and Indonesia, are tiny by comparison.

There are also limits to how much HSBC can rejig its various lines of business. Its strength in trade finance has so far failed to translate into clout in investment banking. Global capital markets are more lucrative, but volatile. In 2018 HSBC launched a new motto, “Together We Thrive”. Its difficulties may have more to do with this grand ambition than with external forces. By trying to do too much for too many people in too many places, it has seen its returns diluted. Yet even for its candid interim boss, that conclusion may be rather too blunt. ■

This article appeared in the Finance and economics section of the print edition under the headline"Failure to thrive"