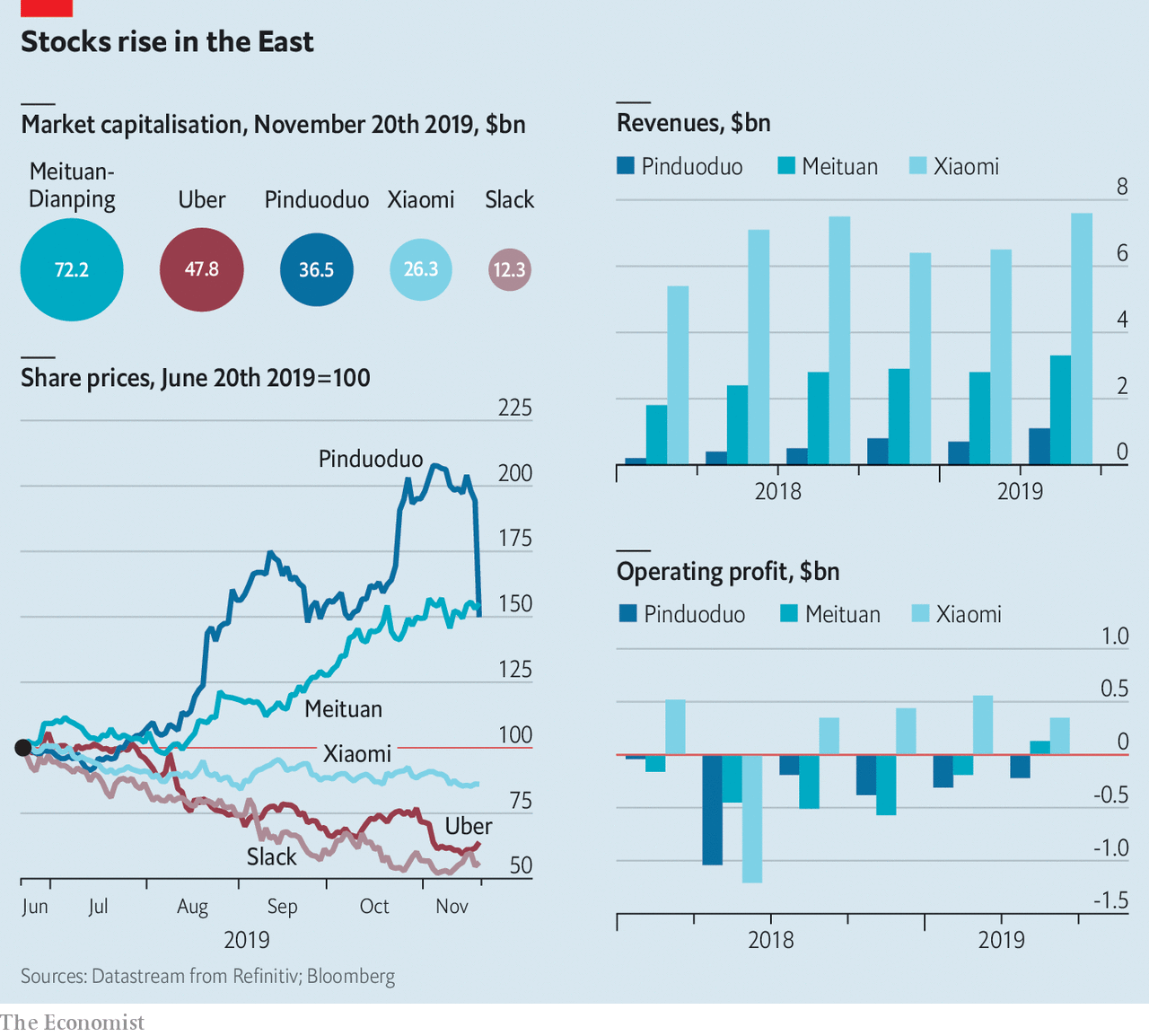

本期经济学人杂志【商业】板块这篇题为《China’s tech darlings have been on a tear》的文章认为相比有些明星初创公司上市后表现不佳,美团和拼多多在过去的半年的表现还不错。美团、拼多多现在市值为 720 亿和 360 亿美元,分别位列中国互联网企业第三、五名。

【on a tear】俚语

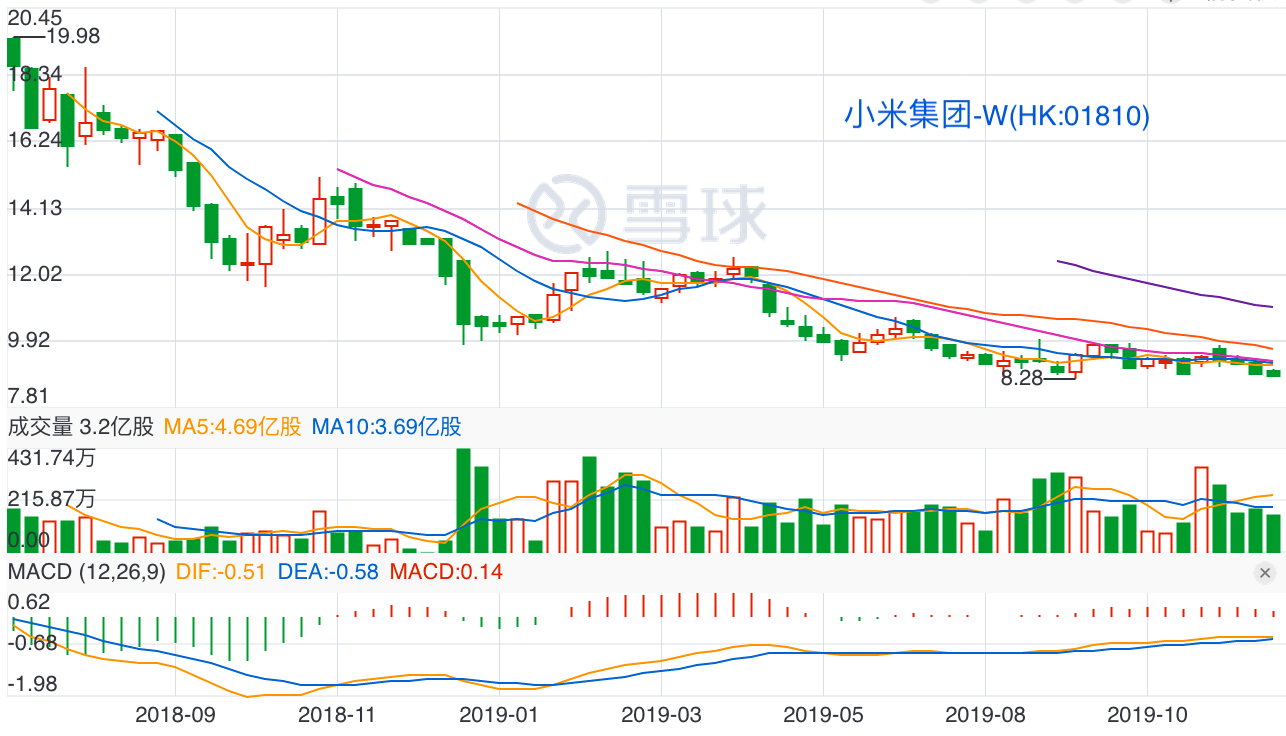

having great success over a period of time 近来美国初创明星公司在上市后表现不尽如人意,有些持续巨额亏损、甚至股价大跌,比如 Uber、Lyft 和 Slack。中国有些科技企业上市后表现也不行,比如小米,截止今年 7 月末,在港交所上市一年后,小米股价腰斩。

过去的 6 个月中,美团和拼多多表现不错,美团第二季度财报显示公司净利润为 1.28 亿美元,首次录得正值。PDD 目前有 5 亿年活跃用户,按照年活跃用户量衡量 PDD 已超过京东成为中国第二大电商公司。但 11 月 20 日,PDD 公布的第三季度财报亏损超过预期,当日股价大跌 23%。

文章最后认为虽然美团、拼多多等目前发展不错,但要想保持这种高速发展的势头却不太容易。No one said staying magical would be easy.

相关文章: 《时代周刊》Uber 第二季度亏损 52 亿美元

China’s tech darlings have been on a tear

Group buy

China’s tech darlings have been on a tear

Meituan and Pinduoduo are now the country’s third- and fifth-biggest listed internet firms

Print edition | Business

Nov 21st 2019| SHANGHAI

America’s technology unicorns, as privately held startups worth $1bn or more are known, seem to lose their magic as soon as they go public. The market capitalisation of Uber is down by almost half since it listed in May. Lyft has shed a bit more even than its bigger ride-hailing rival. Neither is remotely profitable. Slack, a corporate-messaging service, lost $360m in its first quarter as a public company, over ten times more than as a private one a year earlier. Its share price has slid, too (see chart).

China also has its own tech duds. Shares in Xiaomi, a maker of smartphones and gadgets, are worth half of their offering price last July. But other Chinese unicorns have managed to retain some of their mojo.

Two in particular have been on a tear in the past six months: Meituan-Dianping, an online-services super-app that trades in Hong Kong, and Pinduoduo, a shopping app listed on New York’s Nasdaq exchange. With a market capitalisation of $72bn, Meituan is now China’s third-biggest listed internet firm, behind Alibaba and Tencent. Pinduoduo’s $36bn puts it fifth, behind Baidu.

Meituan burned through cash to fuel its food-delivery and bike-rental businesses. Users were delighted; investors, less so. But the strategy appears to have paid off: the company reported its first net profit, of 876m yuan ($128m), in the second quarter. Sanford C. Bernstein, a research firm, reckons that Meituan may continue to make money, not least because its meal-toting rivals—including Alibaba—are losing their appetite to fork out much more.

Pinduoduo, for its part, has overtaken jd.com as China’s second-largest e-commerce site by number of annual buyers (over 500m). It claims to be a combination of Costco (cheap) and Disneyland (thrills). Recruit friends to join you in ordering a crate of 30 kiwis, and their price falls.

Pinduoduo boomed early on in underserved poor cities. But as it moves into richer ones it will come up against Alibaba, whose defences will be bolstered by the up to $12.9bn it plans to raise in a secondary listing in Hong Kong on November 26th. On November 20th Pinduoduo reported a loss in the third quarter that was wider than expected. Its shares fell by 23%. No one said staying magical would be easy.■

This article appeared in the Business section of the print edition under the headline"Group buy"