本期经济学人杂志【商业】板块的这篇题为《Xiaomi’s founder loses a billion-yuan bet》的文章关注的是2013 年雷军和董小姐在第十四届中国经济年度人物颁奖典礼上的 10 亿元打赌终于有了结果,2018 年三四月相继公布的 2017 年财报显示,雷军的小米销售额为 1750 亿元,董小姐领导的格力的销售额为 2000 亿元,董小姐获胜。

文章认为从这两人的赌局中可以看出中国经济和中国企业的发展变化情况。随着中国居民可支配收入的增加,小米和格力在过去的五年中都取得了骄人的成绩,但同时都面临着一些问题,并在寻求改变。比如小米的低成本手机利润非常薄(wafer-thin),格力在家电业务上的份额面临海尔、美的等竞争对手的蚕食。The bet highlights the changing face of China Inc.

Xiaomi’s founder loses a billion-yuan bet

Chinese business

Xiaomi’s founder loses a billion-yuan bet

The wager offers a vignette of corporate China

IN 2013 BUSINESS folk gathered in Beijing to honour Chinese “Economic Figures of the Year” were treated to an unexpected twist. One of the winners, Lei Jun, ventured that in five years the sales of Xiaomi, the smartphone-maker he founded in 2010, would surpass those of Gree, a manufacturer of air-conditioners with government roots. To make things interesting Dong Mingzhu, an entrepreneur and Gree’s chairwoman with whom Mr Lei had shared an award, bet him 1bn yuan ($148m today) that her company’s turnover would stay ahead. Mr Lei accepted. Since March 19th, when Xiaomi posted revenues of 175bn yuan in 2018, corporate China has awaited the figure from Gree. On April 28th the verdict was in: it made 200bn yuan. Mr Lei was out of the money.

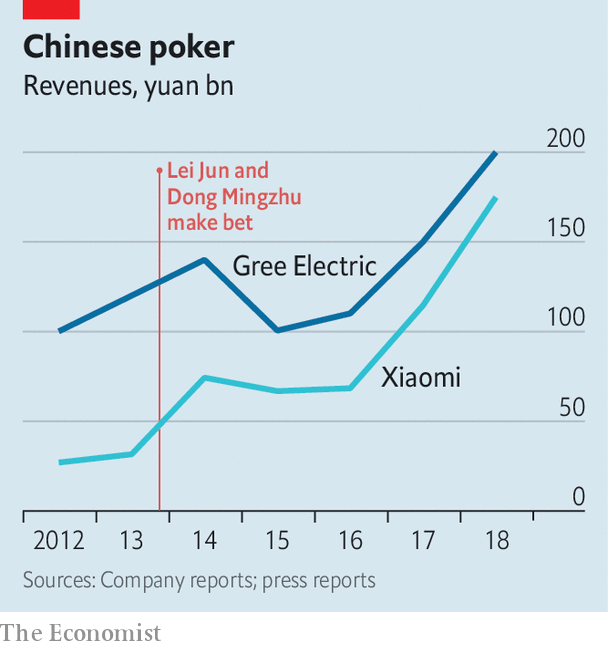

The bet looked bold for Mr Lei in 2013. Xiaomi was then making a quarter of Gree’s 120bn yuan in annual sales. The “Apple of the East”, as it was dubbed, represented a new sort of Chinese company: market-driven and spunky, not state-led and stodgy; online instead of bricks and mortar; relying on digital technology rather than mechanical engineering. By mid-2018 Xiaomi’s revenue neared 90% of Gree’s (see chart). When the firm floated on the Hong Kong stock exchange last July it was valued at $54bn. It has become the fourth-most-valuable Chinese brand, according to BrandZ, a consultancy; Gree is 29th. Ms Dong herself suggested that the wager was meaningless given how different Gree and Xiaomi were.

In reality, the companies are not that dissimilar—and growing less so as China’s economy modernises. Both have boomed thanks to swelling Chinese disposable incomes. The fiercely independent Ms Dong has repeated publicly that her firm must fight for customers just as private ones like Xiaomi do. In April Gree’s largest shareholder, a regulator overseeing state-owned enterprises, said it would sell most of its 18% stake. To build an ecosystem of devices controlled by his mobile phones, Mr Lei relies on closeness to China’s manufacturing heartland, Gree’s home.

They face similar challenges, too. The competition in their core markets is stiff. Xiaomi’s margins from low-cost phones are wafer-thin. Gree has lost share of Chinese air-con sales to rivals such as Haier and Midea, which are introducing more high-tech models. Xiaomi and Gree have both taken a punt on changing their original business models. Gree is selling more online. Xiaomi is opening more physical stores. To keep up with rapidly changing consumer tastes, Gree has moved into smart home appliances, as well as low-emission vehicles and chip design—areas in which Xiaomi now does business, too. Ms Dong now makes smartphones, and Mr Lei has a line of air-conditioners. Whether or not he makes good on it—gambling is outlawed on the mainland—the bet highlights the changing face of China Inc.

This article appeared in the Business section of the print edition under the headline"The billion-yuan bet"

Print edition | Business

May 2nd 2019

| SHANGHAI